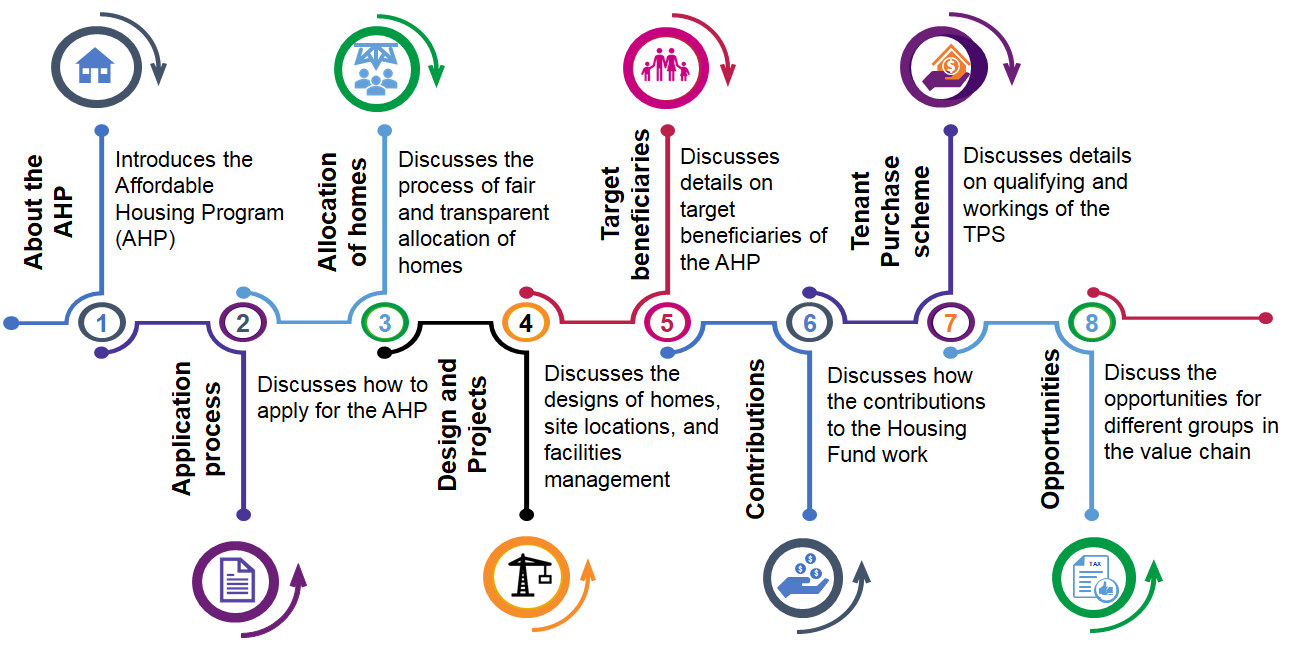

Frequently Asked Questions

The Affordable Housing Program (AHP) is an initiative by the Government as one of the pillars under the ‘Big 4 Agenda’. This pillar targets delivery of decent and affordable housing to low and middle-income households.

The Affordable Houses will be financed and built by private developers on both public (national and county) and private land across the country.

The Affordable Housing Programme is intended to address the housing needs of the following income brackets:

|

Given that these income groups form the bulk of the housing market, the AHP aims to provide them with accessible and standard living spaces. The goal is to promote human dignity and goes a long way in establishing and promoting social equity.

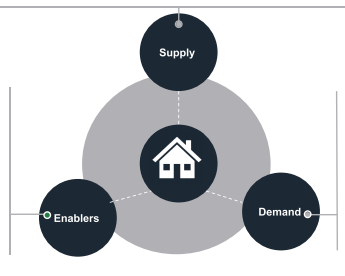

The Government’s main role is primarily that of a facilitator that aims to create an enabling environment for a private sector-led solution that will ensure that the ambitious and capital-intensive becomes a reality. This will be done through several interventions such as:

|

Supply

|

Enablers

|

Demand

|

The Housing Fund is a Fund established under the Housing Act with an aim of delivering affordable housing to Kenyans. The Fund will therefore play a critical role in overcoming the inefficiencies in the housing sector that have led to the housing deficit in the country. This will entail interventions addressing challenges faced from both the supply and demand side of the sector.

The Housing Fund will mobilize private sector investment in the program in order to achieve its objectives. In addition, the Housing Fund will also work with development finance institutions (DFIs) and other development partners to raise the required funding for the projects.

Through the partnerships, the Fund will aggregate demand and link it to the supply from developers. Affordability and access to competitive financing for home owners will be secured by addressing tenure and interest rates through the Tenant Purchase Scheme (TPS) model. Owners will be able to make payments over a 15 - 20 year period with financing of no more than 10% thereby reducing expected monthly payments to manageable levels as well as a possibility for multi-generational mortgages

The Housing Fund as established by the Housing Act is under the control of the National Housing Corporation (NHC) and is thus fully anchored in law. It is institutionally embedded to ensure that we safeguard public funds and that the Fund is managed diligently and transparently. Section 7 of the Housing Acts spells out the administrative guidelines and governance structure that the NHC should adhere to so as ensure the Fund’s autonomy and protect it from manipulation and misappropriation.

The NHC has set up a governance structure comprising of fund custodians to maintain the assets and asset titles of the Fund, a fund administrator to manage the day to day operational affairs of the fund, and a fund manager to direct the fund investments. This structure ensures there is no concentrations of risk, and that the assets of the fund are safeguarded.

The AHP differs from other housing schemes in Kenya. It is the first comprehensive program in which the Government of Kenya seeks to use private sector funding to facilitate the provision of homes to Kenyans in the lower- and middle-income brackets.

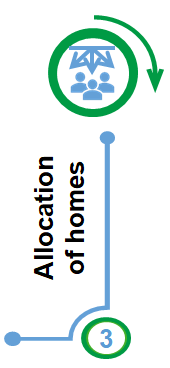

Individuals interested in buying Affordable Houses under AHP will first have to register on the Boma Yangu housing portal, either online or on their mobile phones. Upon registration an account will be automatically created for the member. This will enable you to begin making contributions to the Housing Fund and also to select your housing preference from the available or upcoming housing stock. Once registered and contributing to the Housing Fund, applicants who qualify will participate in a regular and transparent allocation process for the available houses.

There is no fee for applying. It is absolutely free.

All applicants will need to be a citizen of Kenya with a valid national ID number.

No. Members who register on the affordable housing portal, begin making contributions and qualify for affordable housing, will be allocated a house as soon as developers begin constructing affordable houses.

The houses will be awarded through a fair and transparent system, on a first come first serve basis, free of any human intervention and contact

No, the allocation system is not betting. It is a fair and transparent system that allocates houses to qualified applicants without any human intervention, as indicated above. Members will be asked to indicate their preferred location (by county) of a house and then be provided with information on the type of home they qualify for based on their income and required deposit payments.

Homes will be allocated on a first come–first served basis, based on the time when members qualify for allocation meaning they have a full profile (100% complete), they have selected which home they would like to buy, and they have saved the required 12.5% deposit. Potential owners will be selected from this waiting list of registered pre-qualified, eligible applicants.

Allocation processing will be announced on the Housing Portal and through other communication outlets. Allocation will only be carried out for projects that are going live and whose construction has begun.

The weighted pre-qualification criteria will include factors such as income, household status (priority to families), current assets owned, vulnerable groups, accumulated deposit, first come - first serve basis.

Concerning social housing, we will work with settlement executive committees representing community interests and ensuring that those living in the community are beneficiaries. This will entail registration, enumeration, and verification of the community members.

The system is designed to ensure every qualifying applicant is allocated a house. However, it is expected that there will initially be more demand for houses than the supply of affordable houses. If an applicant is not allocated a house in an initial allocation, their name will be put on a waiting list, and the applicant will have a higher likelihood of allocation on subsequent developments.

Yes, the waiting list ensures that those who might have missed out on an initial allocation get priority.

The AHP homes will comprise of houses ranging from one-bedroom to three-bedroom units with varying sizes depending on the locations and the needs analysis. The unit typologies are as follows:

| Type | Size | Price |

|---|---|---|

| One Bedroom | 30 sqm | Kshs 1, 500, 000 |

| Two Bedroom | 40 sqm | Kshs 2, 000, 000 |

| Three Bedroom | 60 sqm | Kshs 3, 500, 000 |

Social Housing:

| Type | Price |

|---|---|

| One Room | Kshs 600, 000 |

| Two Room | Kshs 1, 000, 000 |

| Three Room | Kshs 1, 350, 000 |

To enhance affordability, the program caps the maximum selling price of the housing units as indicated above.

Yes. The AHP is a nationwide program that also seeks to transform millions of Kenyans who live in rural areas. The Government will continue to support homeowners to build houses that fit into the local environment and utilize locally available building materials. One of the major challenges of housing in rural areas is the quality of building materials. To address this, 105 Appropriate Building Technology (ABT) centers have been constructed across the country. We are looking to put up more in every constituency and eventually wards across the country. These will offer technical assistance and equipment to the members of the public to improve the quality of their houses. This initiative aims at addressing the housing needs of various communities in a cost-effective and environmentally sustainable manner. We have also partnered with TVET colleges to train members of the public on how to use these technologies and also how they can modernize construction practices while preserving cultural values. We will also make available for hire Matofali machines used to manufacture stabilized soil blocks. The result will be creating thousands of new jobs that will improve their quality of life and reduce rural-urban migration. Rural housing funding will be available from NHC at a fixed interest rates of 13%.

Regular and timely updates on upcoming projects shall be given on the affordable housing portal and other platforms such as daily newspapers, radio and at your nearest Huduma Center

The AHP anticipates that facilities management will be critical for ensuring that communities remain livable in the long term. Under the current delivery framework, homeowners will be required to pay an affordable service charge towards upkeep of common facilities. A portion of this service charge will go towards a sinking fund for major repairs within a housing complex.

Facilities management will be contracted to companies specializing in these services.

Do I have to be low-income or a first-time homebuyer to benefit from the Affordable Housing Program?

The AHP mainly targets Kenyans in the low and middle-income brackets who have previously been excluded from owning decent homes due to the prohibitive costs and stringent financing requirements. The program seeks to make affordable housing available to all Kenyans by lowering the cost of financing homeownership. The KMRC will provide liquidity and longer-term financing to Kenyan banks and SACCOs in order to increase the volume, tenor of residential mortgages, and availability of fixed-rate mortgages. This is expected to improve the affordability of mortgages, increase the number of qualifying borrowers, and expand the primary mortgage market and homeownership in Kenya.

Applicants will have to be at least 18 years of age.

Since this is a government-backed affirmative program, priority will be given to individuals within households earning less than Ksh150,000. The KMRC introduction aims to lower interest rates on mortgages to below current market rates. This will be accessible to all customers, including those earning over Ksh150,000.

Yes. There are opportunities for civil servants to own homes under the AHP. Therefore, they are encouraged to register in earnest and take advantage of their house allowances to get a better house.

All contributions to the Housing Fund are entirely voluntary. There are no caps on contributions.

Yes- spousal and joint contributions can be made towards the ownership of one house at a time although there is still an option to apply for a house individually. Joint contributions increase that couple’s chances to get their house within a shorter time

Upon registration on Boma Yangu, log into your account, click on “Make a Contribution”. This will allow you to contribute to your account using Mpesa. The Mpesa paybill number is 005500.

You can also contribute to your account by making a deposit through any of the authorized collection banks. The list of participating banks and agencies will be published on the AHP website bomayangu.go.ke.

Be sure to provide your national ID number while making the contribution.

Yes. Members will be able to monitor their contributions via the individual account created on Boma Yangu housing portal.

In the long term, yes. As you contribute and build your savings up to 12.5% of the total value, you eventually get allocated a house or remain on the waiting list – and ultimately, you get your home as projects get developed

Yes. You can apply for withdrawal of contribution at any time through the Boma Yangu portal

Transaction services providers fees will apply.

For payments made through mobile money transfer, the customers will contact the service provider and initiate a reversal. For payments through financial institutions, they will contact the specific banks/institutions and initiate reversal

Contact the Huduma Call Centre for customer support or write to enquiries@bomayangu.go.ke – with proof of payments such as a confirmation message or deposit slip

The amount payable for the house will depend on the type of house selected and allocated. The monthly payments will be determined after taking into account the amount of deposit paid and the desired payment period. The typical payment period will be at least 25 years

The payments shall be made monthly.

No. The payments will be fixed over the life of the financing.

A member is only entitled to one house under the Affordable Housing Program.

Yes. The Housing Fund will provide long-term affordable financing to members that qualify and are allocated an affordable house under a long term Tenant Purchase Scheme.

Yes. However, the applicant will have to prove that they can make their regular monthly loan repayments.

The payment terms are designed to be affordable and flexible, geared towards helping you secure your home. However, every case will be looked at on a case by case basis.

Yes. A member cannot dispose of their house to the open market before 8 years have lapsed. However, before the 8 years are over, they have the option to sell it back to the Housing Fund and retain their equity build up

Information and guidance shall be provided through official communication channels on the State Department for Housing and Urban Development website, on social media platforms and on the Boma Yangu portal.

Incomes will be accessed either individually or jointly depending on if the application is made individually or jointly. If an application is made jointly, the house title will be issued in the name of all the joint applicants.

Income includes any income sources whether regular or irregular.

In the event of death, the housing unit can be transferred to the registered next of kin

Mortgage pre-qualification is available to all members seeking to finance the purchase of their homes using mortgages.

To submit documents for pre-qualification for a mortgage, log into your Boma Yangu account. Click on “Mortgage Prequalification” and submit the required documents.

The mortgage option is a method of payment for a housing unit. Once you have saved the required 12.5% deposit and have been allocated house, you will be required to provide a payment plan for the balance. You can seek a mortgage or loan or payment plan from our partner banks or other financing institutions. The bank or financing institution on the execution of mortgage facility will then deposit the funds in the designated institution as indicated in the sale agreement.

The rate of the mortgage varies depending on the financial institution. SDHUD cannot influence the mortgage rates for financial institutions. However, for institution working in collaboration with KMRC the target is to provide mortgages at a rate less than 10%.

The timelines on refunds will soon be published on the Boma Yangu site, and we will update the public in due course.

Yes, one can have their contributions refunded.

A standard form and instructions to apply for a refund have been provided on the Boma Yangu website, https://bomayangu.go.ke/

The 15 year refund period is not valid. Work is in progress to have refunds be immediate since payments are made voluntarily

The AHP is intended to provide benefits beyond the delivery of affordable homes. The construction of the homes is expected to create direct and indirect employment opportunities for Kenyans. These will include opportunities for both skilled and unskilled labor approximated at 350,000 jobs over a four year period. We estimate that for every unit constructed, there are 3 – 5 new jobs created.

The AHP will create the much needed opportunity to formalize of the informal sector. Ring-fencing strategies will be implemented to ensure that the Jua Kali sector (local artisans and other professionals such as plumbers, electricians and AGPO) are able to make investments and supply inputs to the affordable housing program. This will include among other strategies standardization of inputs such as windows and doors. Light industries will also have the opportunity to provide construction materials such as cement

Other opportunities will be in facilities management aimed at ensuring that common property infrastructure and services are of a quality and functionality that is consistent with the level of physical, social, aesthetic and economic amenity provided by the property at the beginning of the development’s occupancy.

The size of the developments under the Affordable Housing Programme will be significant. It is therefore, anticipated that during the implementation of the program, there will be a rise in the consumption of the various building materials that are locally manufactured.

|

|

|

If you are still experiencing problems, please get in touch with us on email. Write to enquiries@bomayangu.go.ke detailing your challenges and we'll be glad to help

Projects will be countrywide, and the initial phases are as follows: View Housing Projects

Once fully paid, you have the freedom of any other homeowner. A proof will be either sectional title. You own the house even if it has been built on Government land, as long as you have completed payment.

There are several categories of buyers’: -

|

Each of the above will have different requirements for determining full payment.

Yes.

The pricing per unit may vary from one geographical location to another. However, because this is an affordable housing project, the unit cost will be significantly lower than the prevailing market value in that region.

Yes, and it has already been implemented. The public is free to go for site visits as long as they are not in groups

Yes. Registration is done online through the Boma Yangu Portal (www. bomayangu.go.ke). From the homepage, click on the Strategic Partner option on the top right side and follow the prompts.